kern county property tax calculator

Property Tax By County Property Tax Calculator Rethority File an Assessment Appeal. Kern County Property Taxes in Keene CA.

Property Tax By County Property Tax Calculator Rethority

Kern County Treasurer-Tax Collector mails out original secured property tax bills in October every year.

. With easy access to tax sale information and auction results you can research properties and enter bids from anywhere in the world. The first installment is due on 1st. Check your city tax rate from here Thats it you can now get the tax amount as well as the final amount which includes the tax too Method to calculate Kern County sales tax in 2021.

1115 Truxtun Ave Fl 5 Bakersfield CA 93301-4617 Kern County Contact Info. This convenient service uses the latest technology to provide a secure way to bid on tax defaulted property. Box 541004 Los Angeles CA 90054-1004.

661 868 3601 Phone 661 868 3190 Fax Get directions to the county offices For more details about taxes in Kern County or to compare property tax rates across California see the Kern County property tax page. Name A - Z Sponsored Links. 1115 Truxtun Avenue Bakersfield CA 93301-4639.

Purchase a Birth Death or Marriage Certificate. Lake Isabella CA 93240. Secured tax bills are paid in two installments.

Before you start be sure you understand the rules for filling out the forms and arranging your protest. File an Exemption or Exclusion. The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800.

Kern County Treasurer-Tax Collector mails out original secured property tax bills in October every year. While Kern County collects a median of 080 of a propertys each year as property tax the actual amount of property tax collected is lower compared to the rest of California. Find Property Assessment Data Maps.

Stay Connected with Kern County. The 2018 United States Supreme Court decision in South Dakota v. Ad Unsure Of The Value Of Your Property.

A 10 penalty is. This estimator will assist taxpayers who have either recently purchased a property or those considering a purchase during the current fiscal year July 1st - June 30. GENERAL INFORMATION Property Tax Portal.

Has impacted many state nexus laws and sales tax collection requirements. Enter your Amount in the respected text field Choose the Sales Tax Rate from the drop-down list. Kern County California Property Tax Go To Different County 174600 Avg.

Request a Value Review. Search for Recorded Documents or Maps. File an Assessment Appeal.

1115 Truxtun Avenue Bakersfield CA 93301-4639. The first installment is due on 1st November with a payment deadline on 10th December. The countys average effective property tax rate is 081.

Change a Mailing Address. Welcome to the Kern County online tax sale auction website. Find All The Record Information You Need Here.

To avoid a 10. Instructions for Using the Online Benefit Estimator Enter the gross amount of your biweekly compensation. This amount should include your base pay plus any pensionable special pays that apply to you Enter your expected total years of retirement service credit as of your retirement date.

The Kern County property tax deadline has been extended from April 10 to May 4 2020 according to the. Payments can be made on this website or mailed to our payment processing center at PO. Please feel free to enter specific property tax for more accurate estimate.

Auditor - Controller - County Clerk. See reviews photos directions phone numbers and more for Kern County Property Taxes locations in. See Results in Minutes.

Kern County collects on average 08 of a propertys assessed fair market value as property tax. California Mortgage Relief Program Property Tax Assistance. 08 of home value Yearly median tax in Kern County The median property tax in Kern County California is 1746 per year for a home worth the median value of 217100.

Ad Compare Loan Options Calculate Payments Get Quotes - All Online. 800 AM - 500 PM Mon-Fri 661-868-3599. Kern County 2159 California 3818 National 2471 Median home value Kern County 213900 California 505000 National 217500 Median income Kern County 53350 California 75235 National 62843 Owner occupied housing Kern County 05829 California 05485 National 06399 Renter occupied housing Kern County 04171 California 04515.

Enter Any Address Receive a Comprehensive Property Report. The California state sales tax rate is currently. How can we improve this page.

The Kern County sales tax rate is. Website Usage Policy Auditor - Controller - County Clerk. Kern County is responsible for computing the tax value of your real estate and that is where you will submit your appeal.

This is partially because the median property value in Kern County is 16710000 lower than the California median property value of 38420000. 7050 Lake Isabella Blvd. Our Kern County California mortgage calculator lets you estimate your monthly mortgage payment breakdown schedule and more.

Property Tax Rates Report. Kern County CA property tax assessment. County Parish Government Government Offices.

The papers you require and the process youll follow are available at the county tax office or on their website. Get Information on Supplemental Assessments. Stay Connected with Kern County.

Kern County Building Inspection. I hope you find this website informative and helpful and that you return regularly to see what is happening in our office. We use state and national averages when estimating your property insurance.

Like taxes though homeowners. Alta Sierra Arvin Bakers Air Park Bakersfield 1 Bakersfield 2 Bakersfield 3 Bear Valley Bodfish Boron Buttonwillow California City China Lake China Lake Nwc Delano Derby Acres Dustin Acres Edwards Afb Fellows Ford City Frazier Park Golden Hills Inyokern Inyokern Airpt Johannesburg Keene Kernville. How to use Kern County Sales Tax Calculator.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent. DeedAuction is part of our offices. To review the rules in California visit our.

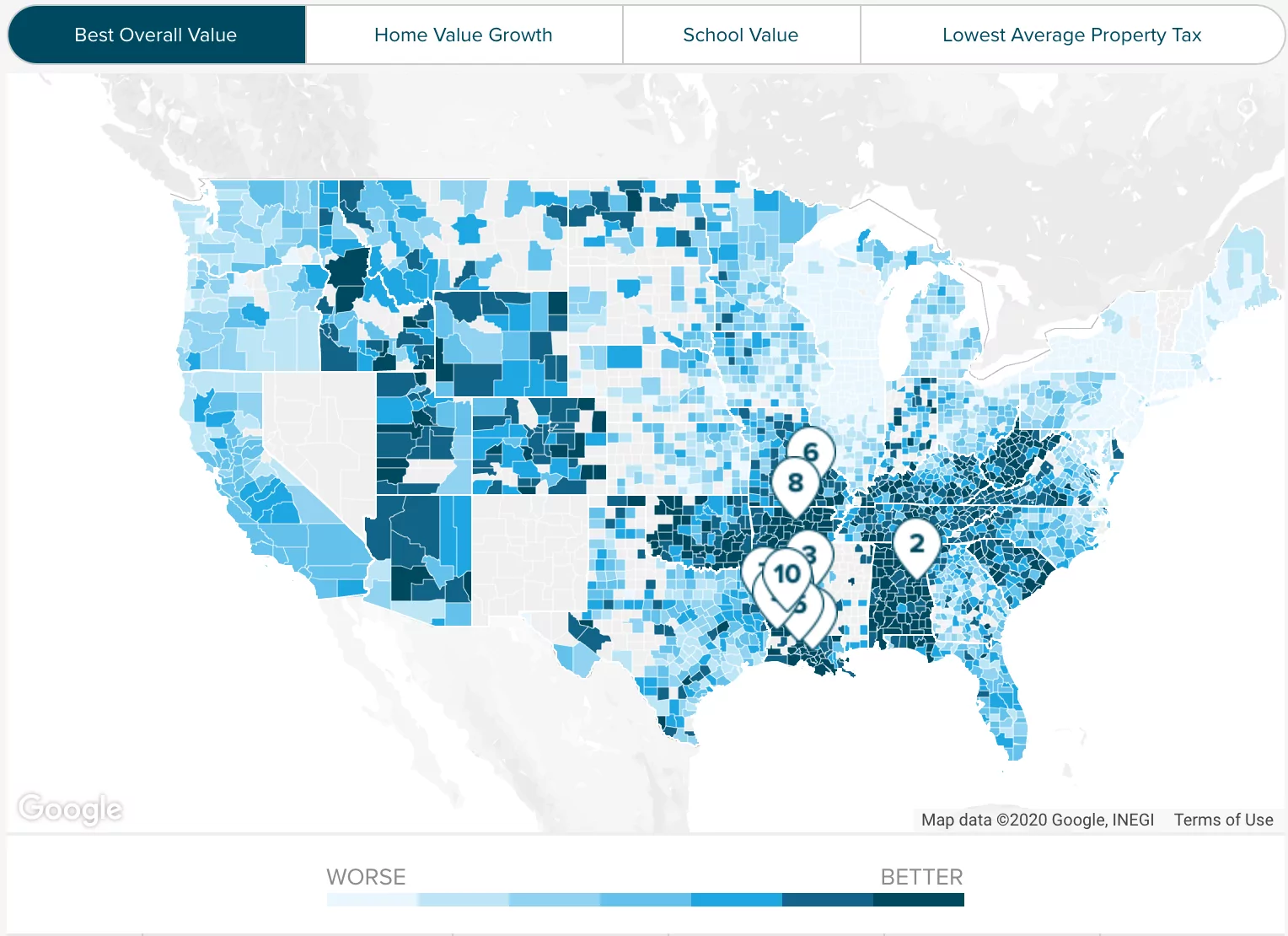

The countys overall median home value is 330600. This is the total of state and county sales tax rates.

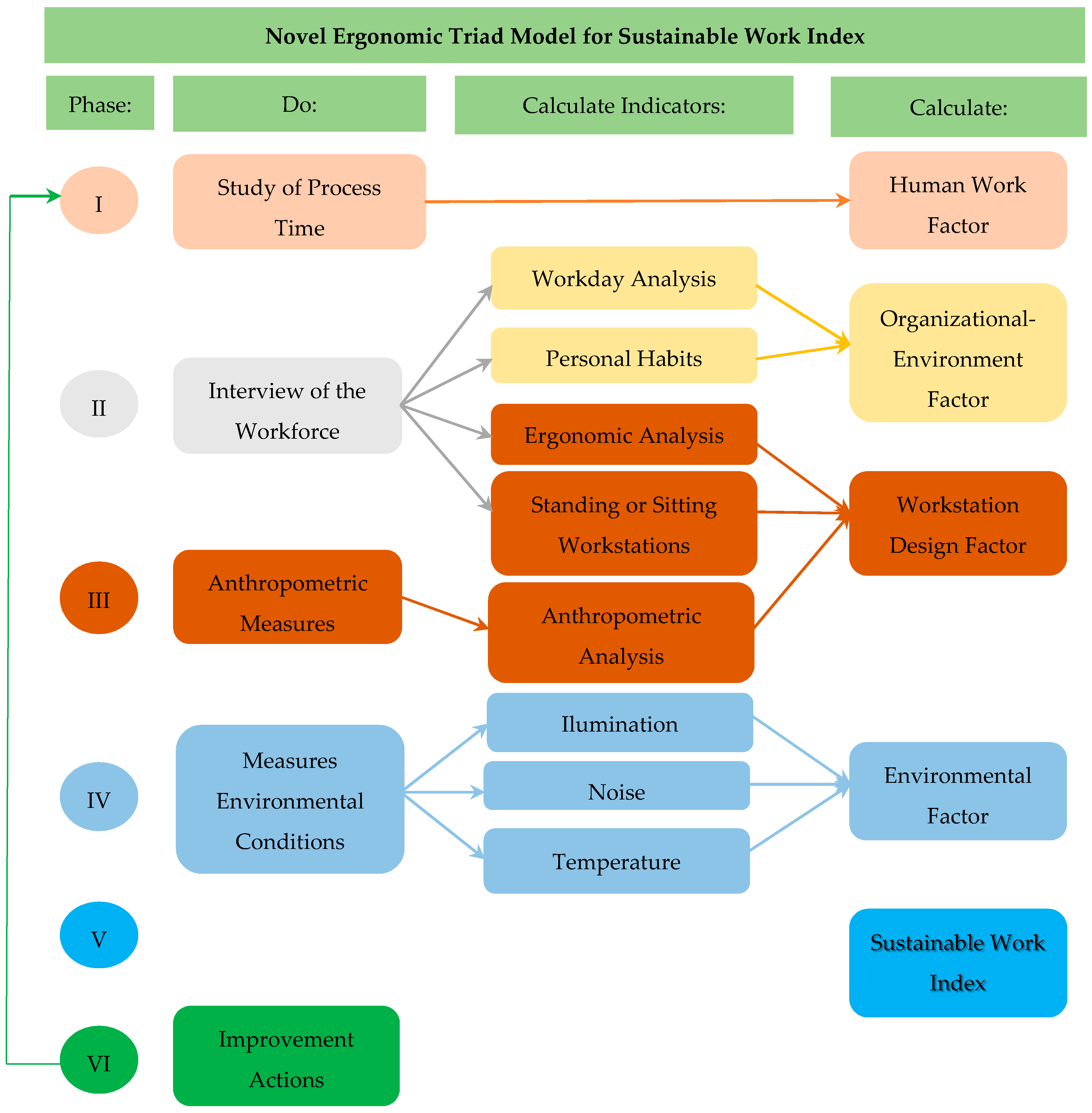

Sustainability Free Full Text Novel Ergonomic Triad Model To Calculate A Sustainable Work Index For The Manufacturing Industry Html

Santa Clara County Ca Property Tax Calculator Smartasset

Transfer Tax Calculator 2022 For All 50 States

Property Tax California H R Block

San Diego County Ca Property Tax Search And Records Propertyshark

What Is A Conditional Approval Mortgage

How To Use A California Car Sales Tax Calculator

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Kern County Treasurer And Tax Collector

Riverside County Ca Property Tax Calculator Smartasset

Home Closing Process For Sellers In California What Are The Costs New Venture Escrow

Notary Invoice Template Notary Public Business Notary Notary Signing Agent

California Vehicle Sales Tax Fees Calculator

Property Tax By County Property Tax Calculator Rethority

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Need To Track Your Dividend Portfolio Step By Step Guide On How To Make A Tracking Spreadsheet Dividend Finance Spreadsheet